Covid-19 Individual Information & Resources

First off let me say that I hope you, your family and friends are doing well, staying healthy and being careful during these crazy times. Until further notice I am not meeting in person but am conducting any scheduled appointments over phone.

Clients can send information to me via my portal (ideal) or by dropping off in my secure window slot downstairs (see picture).

Please see www.wehnercpa.com/delivery for options to get your information to me.

Please contact me if you have any problems using my portal or have any other questions.

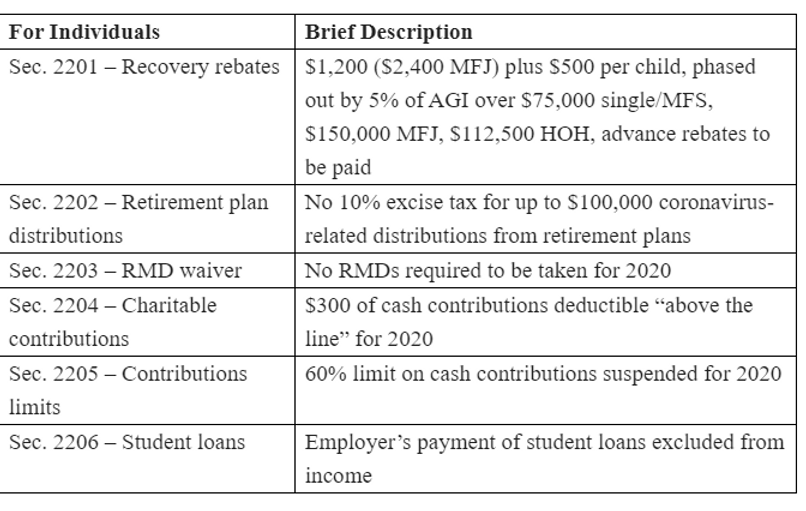

Please click here for a flyer with Individual Provisions

H.R. 748, the “Coronavirus Aid, Relief, and Economic Security Act” or “CARES Act”, passed the Senate last night by unanimous vote. Click here to see the tax relief provisions of the CARES Act or click below:

https://www.wehnercpa.com/cares-act